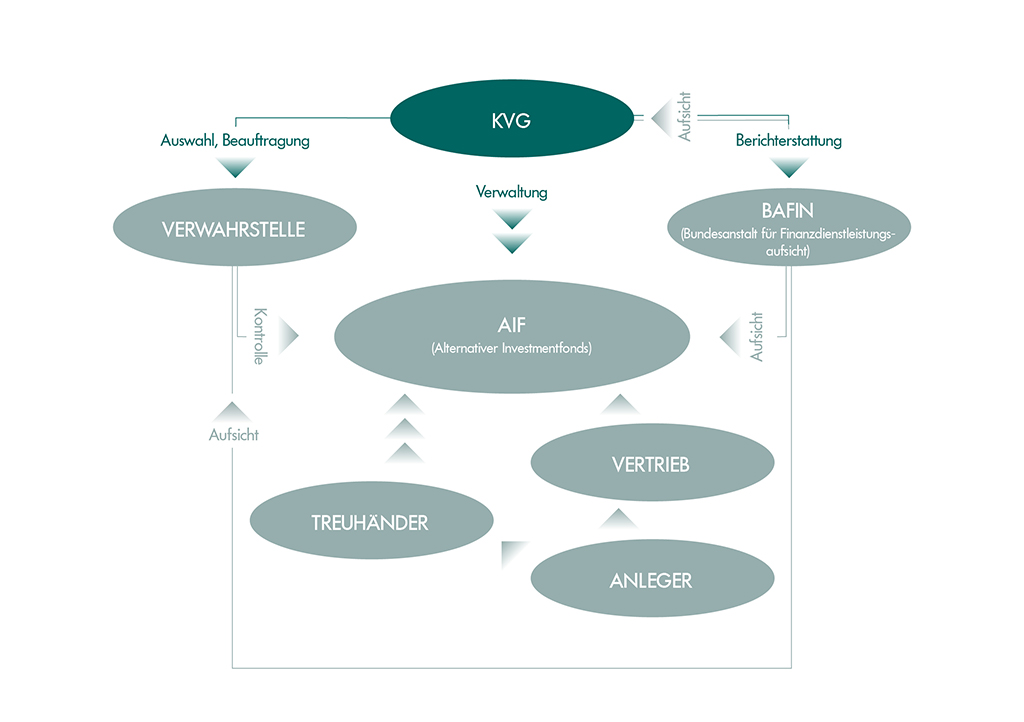

Alpha Ordinatum GmbH is a capital management company (KVG), as defined under the German Investment Act (KAGB). Our range of services comprises the planning and management of domestic investment assets in the form of closed-end public and special AIF (collective asset management). As a service KVG, our offerings are aimed at issuing houses and asset managers focusing on real estate and renewable energies asset classes.

Operating under the motto “Focus on your assets, while we handle the rest“, Alpha Ordinatum covers the full range of services of a service KVG. From risk management and complaint handling and funds accounting to portfolio management, our ability to scale up or down along with short line decision-making ensures that our solutions are tailor-made for each client. Not constrained by rigid structures, Alpha Ordinatum offers flexible and tailor-made solutions that cut through the clutter and zero in on services relevant to our clients, thereby reducing cost.

As a sister company of Primus Valor AG, which for a long time cooperated with external service KVGs, Alpha Ordinatum was created as a logical spin-off.

With many years of client-side experience under the belt, Alpha Ordinatum is well-equipped to understand client needs and wishes. Since we do not issue our own funds, we are free to devote our full attention to supporting our clients.

Within the parameters of such a partnership, Alpha Ordinatum supports Germany’s currently fastest-growing issuer. Alpha Ordinatum GmbH currently manages alternative investment funds with a total equity volume of approx. EUR 325 mn.